The ability to make reasonable estimates is essential in consulting especially when it comes to market sizing. As such, it is something you are very likely to have to do in your case interview. Your interviewer might ask something like:

How many cars are sold in Berlin in one year?

Our client wants to open a pizza restaurant in Rome. How many pizzas should he expect to sell in his first day of activity?

How many people will buy the latest high-end smartphone on the market?

The city of Stuttgart is about to introduce new City Bikes. How many bikes should they buy? How many people will use this service?

Now, there's a small chance you might know the answer to one of these - perhaps you used to live in Germany and worked in the motor industry there. However, the point of such market sizing questions is not to assess your knowledge, but rather to test your reasoning.

When confronted with such questions, the idea is that you should work from what information you do have towards a sensible estimation of the correct value.

We can think of estimation as an "educated guess". However, the word "guess" here does not imply plucking an answer purely from the realms of your own imagination. The watchword at every step of estimation is that what you are doing ought to be reasonable. Even if you somehow got close to the real answer, your interviewer will not be impressed if you cannot demonstrate a sensible rationale for how you arrived at it. In fact, your interviewer will very possibly neither know nor care about the real answer - your capacity to reason is all they are interested in..

Ostensibly, the idea of providing estimates as answers to any of these questions, under time pressure and with no external information, might seem incredibly daunting. However, in this article we discuss how taking a structured approach allows you to break down the problem and makes these kinds of market sizing estimates quite straightforward - you just need to know what you are doing!

Aside

It is worth noting that, despite how strange these kinds of market sizing questions might seem, they are not unique to consulting. Interviewers in many disciplines requiring strong reasoning will frequently give candidates similar problems. In physics, "Fermi" problems (named for Enrico Fermi) - where one might have to estimate the average density of the Earth or the number of atoms in the Great Pyramid at Giza with no additional information - are often used to select candidates with advanced reasoning skills and subsequently to build that capacity during their courses. The takeaway here is that there is a reason why interviewers ask such ostensibly bizarre questions and that you should expect and prepare for them!

Assumptions

We can think of an estimation as resulting from a combination of guessed elements and reasoning/calculation. These guessed elements enter an estimation in the form of assumptions. The presence of assumption is definitive of estimation. One simply cannot have an estimation without making one or more assumptions. Assumptions have a bad name (they famously "make an ass of you and me", right?), and we are used to shying away from them. In other areas, especially in academia, we expend a great deal of effort trying to eliminate assumptions from our reasoning and work directly with fully complete data sets.

However, consultants - as opposed to academics - must always operate within the constraints of the real world - and here the general impossibility of totally complete information makes assumption essential to actually getting anything done.

Assumptions are not the enemy of market sizing, then. By the same token, though, not all assumptions are created equally. The goal of making assumptions is to simplify reality. Our simplifications don't need to be true, but they do need to be reasonable. For example, we might assume that the German population is divided into families of three people. We already know that this is not true, but that does not mean that it is not a reasonable assumption in the correct context - and one that might be useful in generating a solid estimate. By contrast, the assumption that everyone in the population is 35 years old (even if this is the average age for the region) is unlikely to be a reasonable one and probably wouldn't help in making a useful estimation.

Ultimately, you will have to use your own judgement in making assumptions. Different cases will address radically different topics, so any exhaustive treatment here is impossible. As ever, you simply have to be reasonable. For instance, addressing the question about car sales in Berlin, if we have already assumed our population is split into families of three people (as above), it would be reasonable to further assume that each family owns one car and that the lifespan of that car is five years.

Some more generic assumptions which will recur across various cases. In particular, when dealing with normal populations, there are a couple of assumptions which are routinely made in consulting estimations:

-

Linear distribution of age groups

We assume that there are the same number of people in age brackets of the same width. Thus, we assume that there are the same number of people aged 20-30 as aged 70-80 (this would mean that our "population pyramid" was a perfectly regular column). -

Average lifespan is 80 years

We assume that all individuals live for exactly 80 years.

How to tackle market sizing estimations

Now we have a little more understanding as to what an estimation is and what is expected of us when making one, it's time to think about how we should actually go about answering this kind of question.

Looking for an all-inclusive, peace of mind program?

Choose our mentoring programs to get access to all our resources, a customised study plan and a dedicated experienced MBB mentor Learn moreEstimations like the ones listed above can really throw candidates and might seem impossible - especially under the severe time pressure of case interview. However, there really is no reason to panic. Estimations are generally quite straightforward when approached correctly. Learning and applying a systematic and thoughtful approach will take you a long way to very plausible estimates of seemingly impossible quantities - providing you with the skills to answer all kinds of market sizing questions.

In our MCC Academy video lesson on Estimates and Segmentation, we take you, in some detail, through a step-by-step method for making case interview estimations. The space available in an article like this does not allow for such a comprehensive treatment, though. Here we will simply go over some of the key points from that lesson. This should be enough to get you started on estimations, though you should go on to refer to the MCC Academy in future to get yourself fully up to scratch for your interview.

1. Target group for market size estimations

These kinds of market sizing questions all ask about entirely disparate matters of fact, but are often structurally quite similar. In particular, you will frequently be asked to find the size of some target group as a subset of a general population. In case studies, this will generally be to establish the market size in which we want to do business. Thus, asking questions as to how many pizzas a new restaurant in Rome will sell on day one, or how many cars are sold per year in Berlin are effectively asking us to calculate what fraction of the general population will actually buy the products in question.

This kind of "market sizing" exercise is a recurring theme in consulting - and thus interview case studies - as firms will often need to establish the potential for profit of a new marketplace before deciding whether to do business there.

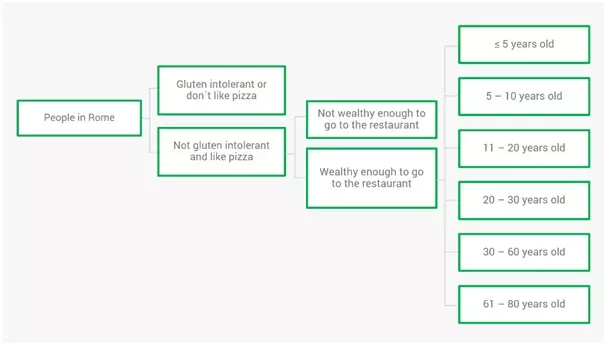

In order to move from the total population to narrowing down the target group, we need to make assumptions about the kinds of people who will be buying (or selling - see next section) our product. For example, if we are answering the question about the Roman pizzeria, we can make a few assumptions relevant to market sizing: a certain fraction of people will be lactose or gluten intolerant - so won't be able to stomach pizza - whilst another fraction simply won't like pizza (inconceivable as it might seem...). Beyond that, if the restaurant is more expensive, a certain fraction of the population won't be able to afford to eat there. After that, we might assume that very young children and the very elderly probably won't be eating pizza. This iterative process is an example of segmentation - which we have a full article on here and which we also discuss in the specific context of market sizing estimates below.

An AI-based, bespoke preparation plan

We’re all trying to get to the same place, but from different starting points. MCC automatically tailors your preparation to your own specific needs. Get started2. Demand side or supply side

Often, the same estimations can be approached in two distinct ways - each a kind of mirror image of the other. For instance, if one is trying to calculate the number of cars sold every year in Berlin, the natural course of action would probably be to consider the number of buyers, as we have done above. However, we might equally well consider the likely number of car dealerships and how many cars per year they sell to maintain their businesses. Thus, we can think about market sizing in terms of the activity of either buyers or providers. In effect, all this means that we might approach the same problem via two different target groups (buyers and providers).

Whether we take a demand or supply side approach will depend upon the specifics of the case in question. It might simply make more sense to focus on buyers or providers in some scenarios - especially where one grouping provides a more salient constraint on the value you wish to calculate - whilst you must also consider which best leverages the information you have available.

3. Segmentation

How do we move from the general population to our target group? Segmentation just means iteratively subdividing a population until we have narrowed down to the segment in which we are actually interested..

Segmentation is fundamentally a process for moving from "big to small". We can attempt to do this all at once - and perhaps it might work out. However, it is far easier - and minimizes the chance of you neglecting something important - to take an iterative approach to segmentation. Thus, for the example of our pizzeria, we should start off by identifying larger groups and then narrowing them down to smaller and smaller segments, until we get to an approximate market size for each group. One way of doing this is visualized nicely in the Venn diagram below.

Just as with choosing the demand or supply side, the key to using segmentation in case studies is to choose the division most appropriate to answer the question at hand and which best leverages the information you have access to. For example, if you are trying to estimate the number of cars in Berlin, it is better to segment by age than, say, by sex. This is because, without needing to do any market research, we can rule out certain age groups as not being drivers (children and the very elderly) and thus not buying cars - whereas people of both sexes drive, so we do not gain anything from making that distinction. By contrast, if we were selling clothing or cosmetics, sex might be a highly relevant segmentation driver.

MECE

When you segment, it is crucial that the divisions you make are MECE - that is, mutually exclusive and collectively exhaustive. We have a whole article on the MECE rule, which you should research if you haven't already. In short, though, we need to make sure that, each time we subdivide a group, no single element ends up in two subsets simultaneously (mutually exclusive) and that every element has a defined subset to which it belongs (collectively exhaustive).

Being MECE is necessary for segmentation to be valid. Keep in mind; just because a segmentation is valid does not mean that it will be useful. As we explain in the main MECE article, there will generally be an indefinite number of possible perfectly-valid segmentations for any sizeable population.

4. Structure

Of course, if you have read our other articles on this site, you will be familiar with our method for building problem driven structures. This kind of structure can be especially useful in cases involving estimation, as it builds in MECE segmentation and iterative narrowing of what we are focussing on whilst also making it easier for you to avoid missing anything or losing track of where you are.

Everything you need in one place

All the most up-to-date resources delivered as a MBA course Learn moreFor the question about estimating the Roman pizzeria's first day sales, we could build a structure as follows:

Practical Concerns

This kind of diagram is useful both to facilitate your own reasoning and to help your interviewer keep track of what you are up to. You don't need to use a tree structure to make a segmentation, but we strongly recommend that you do. This is as much for practical reasons as anything else. It is possible to segment using something like a Venn diagram or pie chart, where you progressively subdivide an area of your page which represents the total population. We showed a very neat one of these in the previous section. However, in real interviews, this kind of diagram would be more likely to end up looking something like the one below (or worse!):

Obviously, this is a bit of a mess. Generally, any kind of Venn diagram or pie chart method means that you are working on a smaller and smaller area of paper as you approach the crucial end-point of your analysis. Your page becomes exponentially messier and more difficult to read, making it harder for your interviewer to follow along and easier for you to get confused - as well as just making you look less-than-competent. One reason why the tree structure is so useful is precisely because the expanding front represented by the end branches means that the part of the diagram you are focusing on naturally expands to meet your needs, avoiding clutter and all the problems that come with it. It might seem trivial, but this orderliness will be key to successful market sizing in practice.

5. Calculate, Check and Improve

Once you have established your target group, decided whether you are going to work on the supply or demand side, have structured your approach, and have followed through with appropriate segmentation, the calculations required to arrive at your final answer should be straightforward. In fact, it can be argued that, if your estimation requires any great level of mathematical sophistication in the calculations, then your approach has not been a sensible one (remember to use our free mental math practice tool make sure your calculation skills are sharp!).

Getting your answer doesn't mean you are finished, though! An estimate is never going to be 100% correct. However, as always, we need to make sure what we have come up with is reasonable. As such, as soon as you have your answer, you should immediately conduct a quick "sense check" to make sure that the value you have arrived at is at least somewhat plausible. Thus, you should always ask yourself "is this answer reasonable?"

If the answer is obviously completely wrong, one likely reason for this is that one of your assumptions has been inappropriate. It may well be possible to tweak this assumption slightly and run the calculations again, though you might not have time to do so.

After the sense check, your final task is to suggest a few ways in which you could improve on your estimation to your interviewer. Obviously, this will be especially important if your current answer is plainly wrong and you don't have time to re-run the analysis. Even if your answer seems very much within the realms of reason, though, there is no estimation that cannot be improved, and being able to suggest ways of doing this demonstrates your understanding of the process as a whole.

Your assumptions inherently involve simplification. As such, you can always make use of more sophisticated assumptions that simplify reality to a lesser degree. Similarly, any segmentation can be made more fine grained, yielding a more accurate estimation. For instance, if you segmented the population into 20-year age bands, you could switch to 10-year or 5-year bands to improve your estimate with a more fine-grained analysis.

Market sizing takeaways

This article should get you up to speed on what is expected from you when your interviewer gives you an estimation question.

In particular, we have learnt that we must give up any pre-existing impression that assumptions are inherently "bad". In short - in the real world - market sizing rests on assumptions to get things done. In consulting, estimations are not ends in themselves but are made to inform business decisions. The idea that estimations simply need to be "reasonable" and "good enough", rather than quantitatively perfect, reflects the general consulting mindset, which we have discussed in other articles on this site. Thus, you should be bringing the general principles of the hypothesis driven approach and ideas like the 80/20 rule to estimation as much as you do to any other case study.

Whilst this article is sufficient to get you started on practicing simpler estimation cases from our case bank, the high likelihood of you being asked to make an estimation in your case interviews means that you should be mastering this skill if you want to start an MBB career. Your best resource here is our full-length video lesson on estimation in the MCC Academy.

Find out more in our case interview course

Ditch outdated guides and misleading frameworks and join the MCC Academy, the first comprehensive case interview course that teaches you how consultants approach case studies.